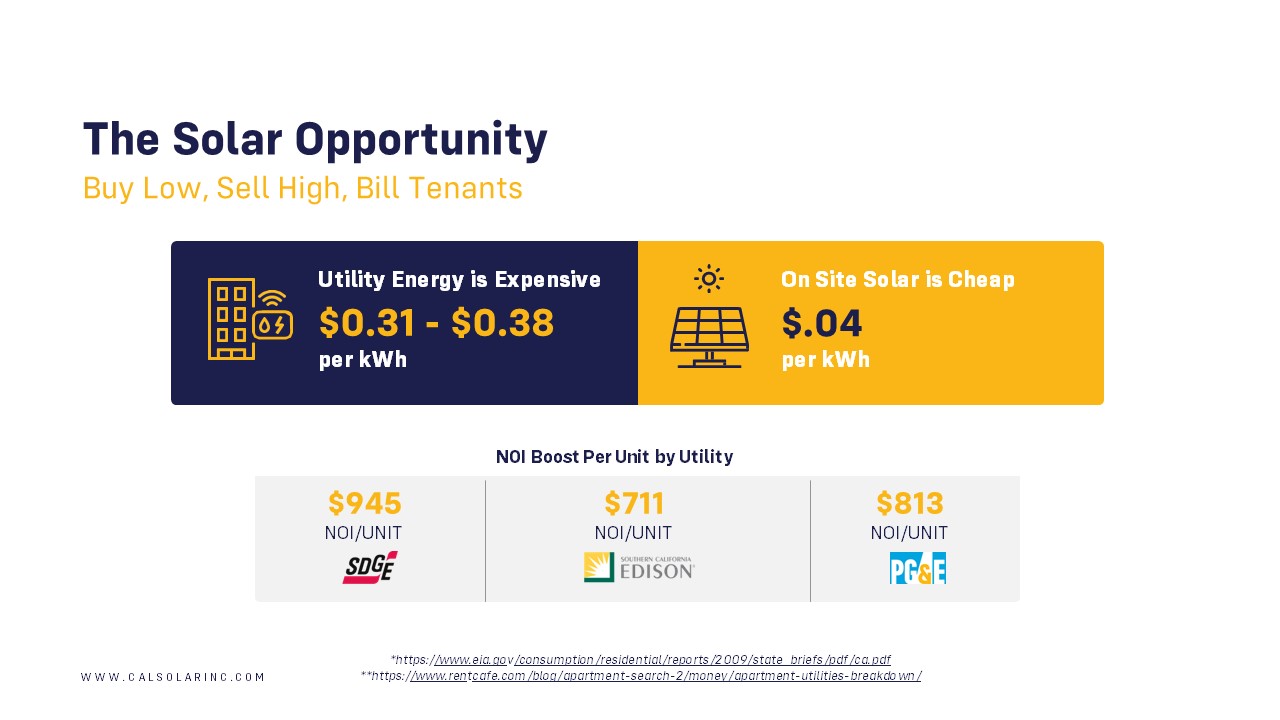

In our first post of this series we explored how to double NOI by shifting the value of solar from the owner-paid common area to tenant usage which offers ~3x more revenue (see image below). In our 2nd post, we looked at how to further leverage the high-return opportunity by increasing the solar pv system size from the 60% offset code minimum to 100% offset, yielding 4x returns.

In the last of our three-part series on monetizing solar code requirements, we will explore how to meet or exceed solar code requirements while eliminating the CapEx of the solar, maximizing NOI and property value. As a design-build contractor, Cal Solar Inc is indifferent to transaction type, so this is truly an objective post focusing on the key insights from financial modeling to compare zero capital cost financing options.

Whether you want to remove CapEx from your budget for Solar, EV Charging, or Energy Storage, or billing tenants for solar simply sounds too far from your core competency, then there are multiple solutions available. As evidenced by the spread in the image above, there is a large opportunity to invest in a solar project and bill tenants for solar while still offering them a ~10% discount off utility rates.

Financiers are now willing to pay the building owner fixed annual solar “Roof lease” or “hosting payments” to have the rights to bill the building’s tenants for solar energy.

Conversely, should the owner want to retain the opportunity and returns for billing the tenants for energy, an owner may opt for a power purchase agreement for the system with a 3rd party financier, and still retain the income delta between the tenant solar billing and off-balance sheet PPA payments.

Solar Hosting Payments

Under this model a third-party financier owns, operates, and maintains the system. In exchange, they have the right to host the solar on your property and bill your tenants for solar at a discount to utility rates. This removes all Capex and Opex associated with Solar and turns it into annual cash flow, NOI, and increased property value via a roof lease payment while their tenants enjoy discounted electricity, shaded parking, and EV charging infrastructure that can all be roped into the agreement.

Power Purchase Agreement

This same concept can be applied via a Power Purchase Agreement (PPA). Both models remove Capex and Opex and enable monetization of the spread between the cost of solar and the higher value of residential electricity. The roof lease payments fix the annual income to the building owner. The PPA enables more upside as the cost of utility energy continues to increase over time enabling this revenue stream to increase while holding the 10% tenant discount fixed. The PPA may also involve extra responsibility in the billing program administration, though it will likely depend on how each offer is structured.

Sizing Optimization

While a larger system makes financial sense, avoiding the Capex and Opex completely, including required carports, makes it a no-brainer to go larger.

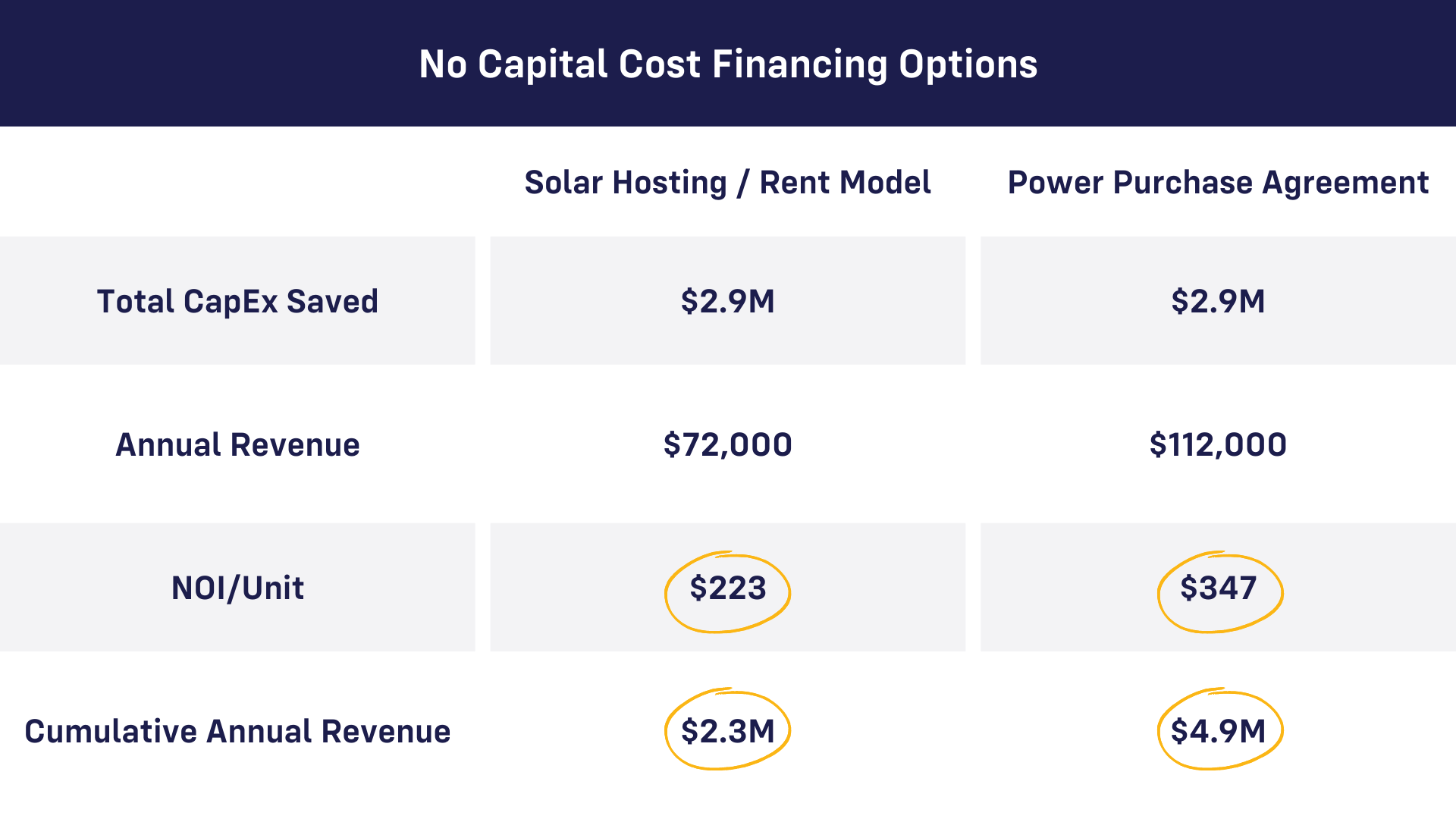

Below is a comparison of two financial options that both remove all Capex and Opex associated with the systems for a ~320-unit multifamily project. Both include O&M and solar tenant billing software. The solar hosting model is the simplest model in that it pays an annual fee to the building owner so the third-party financier can bill tenants for the solar and earn a return on investment. The Power Purchase Agreement enables more upside and value by selling the power at a fixed price to the building owner allowing for the owner to simply take the spread by reselling the power to its tenants.

Solar hosting payments are escalating at 2% over the 25-year term. Under the PPA model, you have both an escalating PPA rate per kWh, but you also have a greater assumed increase in utility rates allowing the solar revenue to go up over time even though the 10% discount to tenants remains fixed. Cumulative Annual Revenue does not include savings from avoided Capex which is an additional $2.9M. The Power Purchase Agreement (PPA) can be backed by credit or PACE allowing payments to be rolled into property taxes.

At Cal Solar Inc, we are indifferent to transaction type and actively facilitate competitive bids and comparative analysis to determine the best fit for every developer. Please contact us if you would like to explore these concepts in more detail for your project.